Do you get confused by the number of car insurance sources available to you? Many other drivers are as well. There are so many sources available that it can turn into a lot of work to find a cheaper company. If you live there, you know that Tampa is the perfect city to reside in, but budgeting for expensive car insurance makes it difficult to meet other financial obligations.

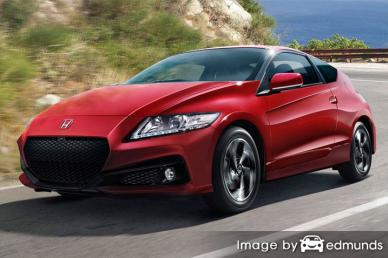

Steps to finding cheaper Honda CR-Z insurance in Tampa

If saving money is your primary concern, then the best way to get budget auto insurance rates is to start doing a yearly price comparison from companies in Tampa.

- Step 1: Get an understanding of how auto insurance works and the things you can change to keep rates in check. Many rating factors that cause high rates such as inattentive driving and a bad credit rating can be remedied by being financially responsible and driving safely. This article gives information to help keep prices low and earn a bigger discount.

- Step 2: Compare rates from exclusive agents, independent agents, and direct providers. Direct and exclusive agents can only quote rates from a single company like GEICO or Allstate, while agents who are independent can provide price quotes from multiple companies. Find a Tampa insurance agent

- Step 3: Compare the new rates to your current policy premium to see if switching to a new carrier will save money. If you find a better price and decide to switch, ensure there is no coverage lapse between policies.

- Step 4: Provide notification to your current agent or company of your intention to cancel your current coverage and submit a completed application and payment for the new coverage. Once the paperwork is finalized, put the new certificate verifying coverage along with the vehicle’s registration papers.

The most important part of shopping around is to use the same deductibles and limits on each quote and and to get price estimates from as many auto insurance providers as possible. This ensures an accurate price comparison and the best price quote selection.

Remarkably, a study showed that most drivers kept buying from the same company for at least the last four years, and nearly 40% of drivers have never compared car insurance rates at all. With the average car insurance premium being $2,200, Florida drivers can cut their rates by $1,126 a year by just comparing rate quotes, but they just feel it’s too hard to shop around.

Remarkably, a study showed that most drivers kept buying from the same company for at least the last four years, and nearly 40% of drivers have never compared car insurance rates at all. With the average car insurance premium being $2,200, Florida drivers can cut their rates by $1,126 a year by just comparing rate quotes, but they just feel it’s too hard to shop around.

If you’re already insured, you should be able to save money using the ideas covered in this article. Finding quotes for the best-priced car insurance in Tampa is not that difficult. But Florida drivers benefit from understanding how the larger insurance companies calculate your policy premium and use this information to your advantage.

Low cost Honda CR-Z insurance prices in Tampa, FL

When price shopping your coverage, making a lot of price comparisons increases your odds of finding the best rates.

The auto insurance companies shown below provide price comparisons in Tampa, FL. To locate cheap car insurance in Tampa, we recommend you compare several of them to get the lowest price.

These discounts can cut Honda CR-Z insurance rates

Companies don’t always list their entire list of discounts very clearly, so the following list contains both the well known and the harder-to-find ways to save on car insurance.

- Military Discounts – Being on active deployment in the military could qualify you for better prices.

- Paperwork-free – Certain insurance companies provide a small discount simply for signing on the internet.

- Driver’s Education for Students – It’s a good idea to have your young drivers enroll and complete driver’s education if offered at their school.

- Air Bags and Passive Restraints – Vehicles with factory air bags or motorized seat belts can qualify for discounts up to 30%.

- Distant Student – Any of your kids who are enrolled in higher education away from home and won’t have access to an insured vehicle could get you a discount.

Don’t be surprised that most discounts do not apply to the whole policy. Some only apply to specific coverage prices like comp or med pay. Even though it may seem like you would end up receiving a 100% discount, you won’t be that lucky.

Companies that possibly offer most of the discounts above are:

When quoting, ask all companies you are considering how you can save money. Some of the discounts discussed earlier may not apply everywhere. To see insurers who offer cheap Honda CR-Z insurance quotes in Tampa, follow this link.

Get More Affordable Auto Insurance with These Tips

A large part of saving on auto insurance is knowing the rating factors that come into play when calculating your auto insurance rates. If you know what impacts premium levels, this enables you to make decisions that will entitle you to big savings.

The following are some of the most common factors used by insurance companies to determine your prices.

Eliminate extra coverages – There are a ton of add-on coverages that can add up when buying auto insurance. Insurance for replacement cost coverage, accident forgiveness, and extra life insurance coverage may not be needed and are just wasting money. They may sound like good ideas when discussing your needs, but if you don’t need them remove them from your policy.

Pay more out-of-pocket – Your deductibles are how much the insured will be required to pay if you file a covered claim. Protection for physical damage, also called comprehensive and collision insurance, is used to repair damage to your car. Some examples of covered claims would be a windshield broken by a bird, damage from fire, and having a roll-over accident. The more money the insured is willing to pay, the less your auto insurance will be.

Tickets can increase premiums – A bad driving record has a big impact on rates. Having just one moving violation may cause rates to rise by as much as thirty percent. Drivers with clean records tend to pay less for car insurance compared to drivers with tickets. Drivers unfortunate enough to have dangerous citations like reckless driving or DUI may find that they have to to submit a SR-22 form to the state department of motor vehicles in order to legally drive.

The higher your credit history the lower your rates – A driver’s credit score is likely to be a major factor in determining your rates. If your credit rating is lower than you’d like, you may save money insuring your Honda CR-Z by repairing your credit. Drivers who have very good credit scores tend to be less risk to insure than drivers who have bad credit.

Honda CR-Z insurance loss data – Auto insurance companies take into consideration historical loss data for every vehicle when setting rates for each model. Models that have a trend towards higher claim severity or frequency will cost more for coverage.

The data below shows the historical loss data for Honda CR-Z vehicles. For each policy coverage, the claim amount for all vehicles combined as an average is a value of 100. Numbers under 100 indicate a favorable loss history, while values over 100 indicate a higher chance of having a claim or an increased chance of larger losses than average.

| Specific Honda Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Honda CR-Z Hybrid | 106 | 87 | 83 | 98 |

Empty fields indicate not enough data collected

Statistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Local agents and insurance

Some people would rather have an agent’s advice and doing so can bring peace of mind An additional benefit of comparing rates online is the fact that you can find cheap insurance quotes but also keep your business local. Supporting local agencies is especially important in Tampa.

Once you complete this quick form, the quote information is transmitted to agents in your area that provide free Tampa auto insurance quotes for your insurance coverage. You don’t have to find an agent as quotes are delivered directly to your email. You can find the lowest rates without having to waste a lot of time. If you have a need to get a comparison quote from one company in particular, you just need to go to their quote page to submit a rate quote request.

Once you complete this quick form, the quote information is transmitted to agents in your area that provide free Tampa auto insurance quotes for your insurance coverage. You don’t have to find an agent as quotes are delivered directly to your email. You can find the lowest rates without having to waste a lot of time. If you have a need to get a comparison quote from one company in particular, you just need to go to their quote page to submit a rate quote request.

Exclusive and independent Tampa auto insurance agents

If you want to buy insurance from a reliable insurance agency, it’s important to understand the different types of agents and how they function. Agents are considered either independent agents or exclusive agents.

Independent Insurance Agents

Independent insurance agents can sell policies from many different companies so they can quote policies through lots of different companies and help determine which has the cheapest rates. To move your coverage to a new company, they simply move the coverage in-house and you don’t have to do anything. When comparing insurance prices, we recommend you get quotes from several independent agencies to have the most options to choose from. Many write coverage with mutual insurance companies which can save you money.

Listed below is a list of independent agencies in Tampa that can give you price quote information.

- Buhl Insurance Agency

2935 W Hillsborough Ave – Tampa, FL 33614 – (813) 876-0057 – View Map - All Affordable Insurance Agency

7211 N Dale Mabry Hwy Suite 108 – Tampa, FL 33614 – (813) 935-5554 – View Map - Northside Insurance Agency

14009 N Dale Mabry Hwy – Tampa, FL 33618 – (813) 960-5225 – View Map

Exclusive Insurance Agencies

These agents have only one company to place business with and some examples include AAA, State Farm, Farmers Insurance, and Allstate. Exclusive agencies are unable to provide rate quotes from other companies so keep that in mind. These agents receive a lot of sales training on the products they sell which helps them sell on service rather than price. Consumers often buy from exclusive agents primarily because of the prominence of the brand and strong financial ratings.

Listed below are Tampa exclusive insurance agencies that can give you price quote information.

- Doug MacDaid – State Farm Insurance Agent

8910 N Dale Mabry Hwy #3 – Tampa, FL 33614 – (813) 935-2937 – View Map - Robin Simmons – State Farm Insurance Agent

2425 S Dale Mabry Hwy a – Tampa, FL 33629 – (813) 258-2828 – View Map - Herma White – State Farm Insurance Agent

14940 N Florida Ave – Tampa, FL 33613 – (813) 961-6661 – View Map

Choosing an insurance agent needs to be determined by more than just a low price. Here are some questions you should ask.

- Which members of your family are coverage by the policy?

- Will they make sure you get an adequate claim settlement?

- Is vehicle damage repaired with OEM or aftermarket parts?

- Is coverage determined by price?

- If they are an independent agency in Tampa, which companies do they recommend?

- Is the coverage adequate for your vehicle?

- Will the agent or a CSR service your policy?

- Which companies can they place coverage with?

If you feel you receive good answers to any questions you have in addition to an acceptable price estimate, you have narrowed it down to an insurance agency that meets the criteria to properly service your insurance policy. Keep in mind you have the power to cancel your policy at any time so don’t feel that you are obligated to a policy for the entire policy term.

Do I need special coverages?

When quoting and choosing your policy for your personal vehicles, there is no perfect coverage plan. Your financial needs are unique.

These are some specific questions can aid in determining if you would benefit from an agent’s advice.

- Do I need replacement cost coverage on my Honda CR-Z?

- What policy terms are available?

- Should I carry comprehensive and collision coverage?

- When should I have rental car coverage?

- When should I not buy collision coverage?

- Can I use my car for my catering business?

If it’s difficult to answer those questions, you might consider talking to a licensed insurance agent. If you don’t have a local agent, take a second and complete this form.

Find affordable rates by comparing often

You just learned some good ideas how to shop for Honda CR-Z insurance online. The key thing to remember is the more you quote Tampa auto insurance, the better your comparison will be. Consumers may even find the lowest prices are with the least-expected company.

More affordable car insurance in Tampa can be sourced online in addition to many Tampa insurance agents, and you need to price shop both so you have a total pricing picture. Some companies don’t offer the ability to get a quote online and usually these regional carriers work with local independent agents.

When you buy Tampa auto insurance online, never buy poor coverage just to save money. There are many occasions where an insured cut comprehensive coverage or liability limits only to find out that their decision to reduce coverage ended up costing them more. Your aim should be to buy the best coverage you can find at an affordable rate, but don’t skip important coverages to save money.

How to buy cheaper Honda CR-Z insurance in Tampa

Truthfully, the best way to get the cheapest Honda CR-Z insurance is to start comparing prices yearly from providers in Tampa. Price quotes can be compared by following these steps.

- Get an understanding of how your policy works and the changes you can make to prevent expensive coverage. Many rating factors that cause rate increases such as accidents, traffic violations, and an imperfect credit rating can be rectified by making small lifestyle or driving habit changes.

- Get rate quotes from direct carriers, independent agents, and exclusive agents. Direct companies and exclusive agencies can give quotes from one company like Progressive and State Farm, while independent agents can provide prices for a wide range of companies. Compare rates

- Compare the new rate quotes to the price on your current policy and see if there is a cheaper rate in Tampa. If you can save some money and decide to switch, make sure there is no lapse between the expiration of your current policy and the new one.

The most important part of shopping around is to make sure you’re comparing identical limits and deductibles on every quote request and and to get quotes from as many companies as feasibly possible. Doing this ensures an accurate price comparison and a complete rate analysis.

Other articles

- What to do at the Scene of an Accident (Insurance Information Institute)

- What Insurance is Cheapest for Homeowners in Tampa? (FAQ)

- Who Has Affordable Auto Insurance Rates for Nurses in Tampa? (FAQ)

- Who Has the Cheapest Tampa Car Insurance Rates for a Dodge Ram? (FAQ)

- Hybrid vehicles cost insurers more (Insurance Institute for Highway Safety)

- All About Airbag Safety (State Farm)

- Self-driving cars won’t replace humans (Insurance Institute for Highway Safety)