It’s a fact that auto insurance companies don’t want you to compare rates. People who get price quotes annually are likely to switch to a new company because of the good chance of finding a policy with better rates. A study discovered that consumers who compared rates regularly saved approximately $860 a year compared to other drivers who never shopped around for lower prices.

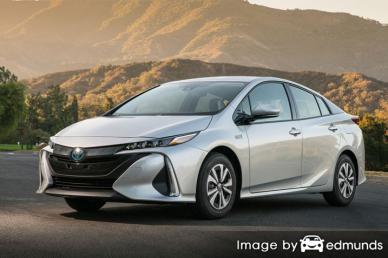

If finding the cheapest rates on Toyota Prius Prime insurance is your goal, then having some insight into the best ways to shop for coverages can help make the process easier.

Truthfully, the best way to save money on Toyota Prius Prime insurance is to regularly compare price quotes from different companies who provide auto insurance in Tampa.

Truthfully, the best way to save money on Toyota Prius Prime insurance is to regularly compare price quotes from different companies who provide auto insurance in Tampa.

- Step 1: Try to comprehend how auto insurance works and the measures you can take to prevent expensive coverage. Many risk factors that result in higher prices such as tickets, at-fault accidents, and a bad credit score can be controlled by paying attention to minor details. Later in this article we will cover ideas to help prevent expensive coverage and find overlooked discounts.

- Step 2: Request rate estimates from exclusive agents, independent agents, and direct providers. Direct and exclusive agents can only provide price estimates from a single company like Progressive and State Farm, while independent agents can give you price quotes from multiple companies.

- Step 3: Compare the new rate quotes to your current policy premium to see if cheaper Prius Prime coverage is available. If you find a lower rate quote and decide to switch, make sure there is no coverage gap between policies.

- Step 4: Provide proper notification to your current company of your intention to cancel your existing policy and submit a signed application and payment to your new carrier. As soon as you have the new policy, safely store the proof of insurance certificate along with your vehicle registration.

The most important part of shopping around is that you’ll want to make sure you compare similar deductibles and liability limits on each quote request and and to get price estimates from as many different insurance providers as possible. This ensures a level playing field and a thorough price selection.

The fastest way that we advise to compare insurance rates from multiple companies is to realize almost all companies have advanced systems to provide you with a free rate quote. All you need to do is provide a little information such as coverage limits, whether you are married, whether or not you need a SR-22, and if it has an anti-theft system. Your details gets sent immediately to insurance carriers in your area and they return rate quotes quickly.

To compare cheap Toyota Prius Prime insurance rates now, click here and complete the form.

The companies in the list below can provide quotes in Florida. If your goal is to find cheap car insurance in Tampa, we suggest you get prices from several of them to find the lowest auto insurance rates.

Here’s why auto insurance is not optional

Despite the high insurance cost for a Toyota Prius Prime in Tampa, insuring your vehicle is required for several reasons.

- Almost all states have mandatory liability insurance requirements which means you are required to carry a specific level of liability insurance in order to drive the car. In Florida these limits are 10/20/10 which means you must have $10,000 of bodily injury coverage per person, $20,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If you bought your Toyota Prius Prime with a loan, more than likely the lender will have a requirement that you buy full coverage to guarantee their interest in the vehicle. If you do not pay your insurance premiums, the lender may have to buy a policy to insure your Toyota at a much higher premium rate and force you to pay for the much more expensive policy.

- Insurance safeguards not only your car but also your assets. Insurance will also pay for medical expenses for not only you but also any passengers injured in an accident. Liability insurance will also pay attorney fees if you are sued as the result of an accident. If your Toyota gets damaged, collision and comprehensive (also known as other-than-collision) coverage will pay all costs to repair after the deductible has been paid.

The benefits of carrying adequate insurance are without a doubt worth the cost, specifically if you ever have a liability claim. In a recent study of 1,000 drivers, the average customer is currently overpaying as much as $820 a year so you should quote and compare rates at every policy renewal to help ensure money is not being wasted.

Auto insurance rates and discounts

Some insurance providers don’t always list all available discounts very well, so below is a list some of the more common as well as some of the hidden savings tricks you should be using when you buy Tampa auto insurance online.

- Federal Government Employee – Federal government employees could cut as much as 10% off with select insurance companies.

- Theft Prevention System – Cars and trucks optioned with advanced anti-theft systems prevent vehicle theft and will save you 10% or more on Prius Prime insurance in Tampa.

- Student in College – Older children who are enrolled in higher education away from home and do not have access to a covered vehicle may be insured at a cheaper rate.

- Discount for Home Ownership – Owning a home in Tampa may earn you a small savings because it means you have a higher level of financial diligence.

- Paperwork-free – A handful of companies may give you up to $50 for completing your application on your computer.

- Telematics Discount – Drivers who elect to allow data collection to study driving patterns by using a telematics device such as In-Drive from State Farm or Allstate’s Drivewise system could save a few bucks if their driving habits are good.

- Driver’s Ed – Require your teen driver to take driver’s ed class as it can save substantially.

As a footnote on discounts, many deductions do not apply to the entire policy premium. Most cut the cost of specific coverages such as medical payments or collision. So when the math indicates you would end up receiving a 100% discount, company stockholders wouldn’t be very happy. Any qualifying discounts will cut your overall premium however.

If you would like to view insurance companies who offer auto insurance discounts in Florida, click here.

When do I need to contact an insurance agency?

Certain consumers just want to get advice from a local agent and doing that can be a smart decision Good agents can help you build your policy and will help you if you have claims. An additional benefit of price shopping on the web is you may find the lowest rates and still have an agent to talk to. Buying from and supporting local agencies is important especially in Tampa.

To find an agent, once you fill out this form (opens in new window), your coverage information gets sent to companies in Tampa that provide free Tampa auto insurance quotes and help you find cheaper coverage. You don’t have to leave your house due to the fact that quote results will go immediately to your email address. If for some reason you want to get a rate quote from a specific insurance company, feel free to visit that company’s website and give them your coverage information.

To find an agent, once you fill out this form (opens in new window), your coverage information gets sent to companies in Tampa that provide free Tampa auto insurance quotes and help you find cheaper coverage. You don’t have to leave your house due to the fact that quote results will go immediately to your email address. If for some reason you want to get a rate quote from a specific insurance company, feel free to visit that company’s website and give them your coverage information.

Exclusive agents vs. Independent agents

If you are wanting to purchase insurance from a local Tampa insurance agency, it’s important to understand the different agency structures and how they can write your policy. Agents are considered either exclusive or independent. Both write policy coverage, but it’s good to learn the difference in the companies they write for because it can factor into the kind of agent you use.

Independent Agents

Agents that choose to be independent can quote rates with many companies so they can write business amongst many companies enabling the ability to shop coverage around. If you want to switch companies, they simply switch companies in-house which makes it simple for you. When comparing rates, it’s recommended you get insurance quotes from independent agents to get the most accurate price comparison.

Below are Tampa independent agents that may be able to provide comparison quotes.

All Affordable Insurance Agency

7211 N Dale Mabry Hwy Suite 108 – Tampa, FL 33614 – (813) 935-5554 – View Map

A Complete Insurance Agency

5008 W Linebaugh Ave – Tampa, FL 33624 – (813) 865-9000 – View Map

American Landmark Insurance

4229 W Kennedy Blvd – Tampa, FL 33609 – (813) 289-2277 – View Map

Exclusive Insurance Agencies

Exclusive agents normally can only provide a single company’s rates and some examples include American Family, State Farm, and AAA. Exclusive agents cannot shop your coverage around so they really need to provide good service. They are trained well on their products and sales techniques which helps overcome the inability to quote other rates.

Below is a list of exclusive insurance agents in Tampa willing to provide price quote information.

American Family Agencies

8501 N Florida Ave – Tampa, FL 33604 – (813) 930-0400 – View Map

Allstate Insurance: Paul H. Phaneuf

3641 W Kennedy Blvd F – Tampa, FL 33609 – (813) 353-0303 – View Map

Pam Williams – State Farm Insurance Agent

10005 Gallant Ln – Tampa, FL 33625 – (813) 963-3216 – View Map

Choosing the best car insurance agent should include more criteria than just the price. Some important questions to ask are:

- How much will you save each year by using a higher deductible?

- Is there a 24/7 contact number?

- Will your rates increase after a single accident?

- Will you work with the agent or an assistant?

- Are glass claims handled on-site or do you have to take your vehicle to a repair shop?

- What companies can they write with?

- How long has the business existed?

- Do they have adequate Errors and Omissions coverage? This protects you if they make a mistake.

If you get answers to your satisfaction to these questions and locked in a price quote, you may have just found an insurance agent that is professional and can insure your vehicles. Just be aware that once you purchase a policy you can terminate your policy whenever you want so don’t assume that you are obligated to any specific agency for the entire policy term.

How much auto insurance do I need?

When it comes to choosing proper insurance coverage, there really isn’t a perfect coverage plan. Your financial needs are unique so this has to be addressed.

For example, these questions could help you determine whether your personal situation could use an agent’s help.

- Does low annual mileage earn a discount?

- Does insurance cover damages from a DUI accident?

- Am I getting all the discounts available?

- Are rock-chip repairs free?

- Am I covered when driving on a suspended license?

- Is pleasure use cheaper than using my Toyota Prius Prime to commute?

- Is upholstery damage covered by car insurance?

- Can good grades get a discount?

- Does my insurance cover a custom paint job?

- Will filing a claim cost me more?

If you’re not sure about those questions, you might consider talking to a licensed insurance agent. To find an agent in your area, take a second and complete this form or you can go here for a list of companies in your area. It is quick, free and you can get the answers you need.

Specific coverage details

Having a good grasp of car insurance aids in choosing the right coverages and proper limits and deductibles. Policy terminology can be confusing and reading a policy is terribly boring. Listed below are typical coverages found on the average car insurance policy.

Comprehensive coverage (or Other than Collision) – This pays for damage caused by mother nature, theft, vandalism and other events. You need to pay your deductible first then the remaining damage will be covered by your comprehensive coverage.

Comprehensive coverage pays for claims like falling objects, damage from getting keyed, fire damage and vandalism. The maximum payout you’ll receive from a claim is the actual cash value, so if the vehicle’s value is low it’s not worth carrying full coverage.

Insurance for medical payments – Coverage for medical payments and/or PIP kick in for bills for things like dental work, ambulance fees, rehabilitation expenses and doctor visits. They can be used to fill the gap from your health insurance policy or if you are not covered by health insurance. Medical payments and PIP cover all vehicle occupants and will also cover getting struck while a pedestrian. PIP is only offered in select states and gives slightly broader coverage than med pay

Uninsured Motorist or Underinsured Motorist insurance – This protects you and your vehicle from other motorists when they are uninsured or don’t have enough coverage. This coverage pays for hospital bills for your injuries as well as damage to your Toyota Prius Prime.

Because many people only purchase the least amount of liability that is required (which is 10/20/10), their liability coverage can quickly be exhausted. For this reason, having high UM/UIM coverages is a good idea. Most of the time these coverages do not exceed the liability coverage limits.

Liability coverages – Liability coverage provides protection from damage that occurs to other’s property or people in an accident. Split limit liability has three limits of coverage: per person bodily injury, per accident bodily injury, and a property damage limit. You commonly see limits of 10/20/10 which stand for $10,000 in coverage for each person’s injuries, $20,000 for the entire accident, and a total limit of $10,000 for damage to vehicles and property. Occasionally you may see a combined limit which limits claims to one amount and claims can be made without the split limit restrictions.

Liability insurance covers claims such as medical expenses, repair costs for stationary objects, legal defense fees, emergency aid and bail bonds. How much coverage you buy is a personal decision, but buy higher limits if possible. Florida requires minimum liability limits of 10/20/10 but you should think about purchasing better liability coverage.

The chart below shows why low liability limits may not be adequate coverage.

Collision coverage – This coverage covers damage to your Prius Prime from colliding with another vehicle or an object, but not an animal. You will need to pay your deductible then the remaining damage will be paid by your insurance company.

Collision can pay for claims such as rolling your car, crashing into a ditch and backing into a parked car. Paying for collision coverage can be pricey, so consider dropping it from lower value vehicles. It’s also possible to increase the deductible on your Prius Prime to bring the cost down.

In Summary

Some companies may not have online quoting and these regional carriers prefer to sell through independent agents. Cheaper insurance in Tampa is available from both online companies as well as from insurance agents, so you should be comparing quotes from both in order to have the best chance of saving money.

When searching for low cost Tampa auto insurance quotes, make sure you don’t skimp on coverage in order to save money. In many cases, an accident victim reduced liability coverage limits to discover at claim time that the few dollars in savings costed them thousands. The ultimate goal is to purchase a proper amount of coverage for the lowest price and still be able to protect your assets.

More detailed insurance information is located by following these links:

- Drunk Driving Statistics (Insurance Information Institute)

- Who Has Cheap Auto Insurance Quotes for a Toyota RAV4 in Tampa? (FAQ)

- How Much are Auto Insurance Quotes with Multiple Speeding Tickets in Tampa? (FAQ)

- What Insurance is Cheapest for Drivers with Bad Credit in Tampa? (FAQ)

- Who Has Affordable Tampa Car Insurance Quotes for a Jeep Wrangler? (FAQ)

- Who Has Affordable Auto Insurance for Unemployed Drivers in Tampa? (FAQ)

- Front crash protection reduces rear-end crashes (Insurance Institute for Highway Safety)

- What to do at the Scene of an Accident (Insurance Information Institute)